Basic Documents required for a Mortgage:

1) Proof of Identification

Original documents need to be provided (e.g. Passport, Full UK/EU driving licence, National Identity Card, Government Dept ID (Police, Army) or Disabled Person Blue Parking Badge.)

2) Proof of Address

An orginal proof of address needs to be dated within the last three months if using: Recent utility bill, recent mortgage statement Or Bank/building society statement- if posted. Alternatively you can provide a council tax bill, Full UK/EU driving licence - if not used for ID.

3) Proof of Income

If Employed

We will require the latest 3 months Payslips showing your income. If paid weekly please send 12 weeks worth of payslips or the equivalent of 3 months if paid differently.

If you have just started a job some lenders will accept an employment contract from your new employer and/ or any payslips you may have.

1.Employee name must be shown or if the name is on the detachable part of the payslip, we'll need to see a copy of this.

2.Pay date and tax period must be clearly shown. On all 3 of your latest payslips.

3.Gross pay. We need to identify your normal salary. This could be basic salary, contractual pay, salary or notional salary.

4.If you're including bonus, overtime or commission, we may ask for additional payslips where you're using any or all of these.

5.Additional allowances. some times we can use certain allowances as part of your basic pay including car, location and shift allowances.

6/7.If there is an address on your payslip, this should match your current address.

8.Your payslip (including any detachable parts) must show your employer's name. If your employer's name isn't on the payslip or any bank statements, you'll need to provide your P60.

9.Please include outgoings (e.g. student loan payments or childcare vouchers).

10.Your payslip must show your gross pay.

11.Your payslip must show your net pay.

If Self Employed

As a self employed mortgage applicant you will have been asked to produce your SA302 tax certificates and Tax Year Overview for recent years trading.

There are currently 3 options available to obtain your SA302 figures:

- Ask your Accountant to produce the figures from their 3rd party accountancy software.

- Request from HMRC to be sent it out by post or fax with a covering letter.

- Download the figures from the .gov.uk website.

We need your latest 3 years SA302 Tax Calculation's/ Tax Computation's (or all available if trading for less than 3 years)

And all corresponding Tax year overviews to match the SA302's/ Tax Comp's.

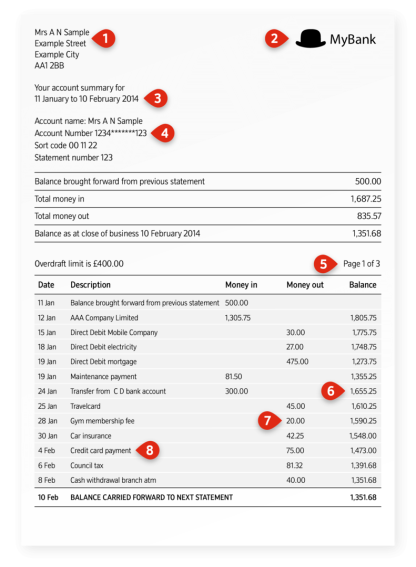

4) Bank Statements

We will require the latest 3 months Bank statements for all accounts held, showing your income and expenditures.

*If using posted Bank statements we can use this as proof of address too, providing the statement are NOT online statements.

1.The statement must show your full name or initials, surname, and your address.

2.The Building Society/Bank logo must be shown.

3.Bank statements must be full month statements for the number of months requested and must be the latest received.

4.Bank account and sort code numbers must be shown.

5.All pages of the statement(s) must be included.

6.A running balance must be shown.

7.If the bank statement provided is from a current account, we should be able to see that payments have left the account.

8.Showing outgoings (e.g. loan and credit cards).

5) Proof of Deposit

If not shown on your bank statements, a bank or building society statement showing your mortgage deposit funds will be required.

If using a gift of deposit from family or friends, please use the form below.

TO MEET FIRST COMPLETE AND THE FINANCIAL CONDUCT AUTHORITY GUIDELINES THE ABOVE DOCUMENTATION IS A MANDATORY REQUIREMENT TO ASSESS AFFORDABILITY PRIOR TO ANY APPLICATION FOR A MORTGAGE.

*Further documents may be required

6) Details of current debts

Additional Documents (If applicable)

Proof of Child / Working Tax Credits

Must include all pages.

P60

Not always needed but if you have your P60 available or you have just received your latest one, we can use this to support your proof of income/ overtime/ commission.

Credit Report

If you believe you have had any credit issues in the past involving miss payment, defaults ect... please provide a recent credit report.